Your AI assistant for lender policy questions.

Ask any policy question in plain English. Get instant, grounded answers with source attribution — so you spend less time searching and more time settling.

Everything you need to navigate lender policies with confidence.

Stop digging through PDFs and portals. Get the policy answers you need in seconds, not hours.

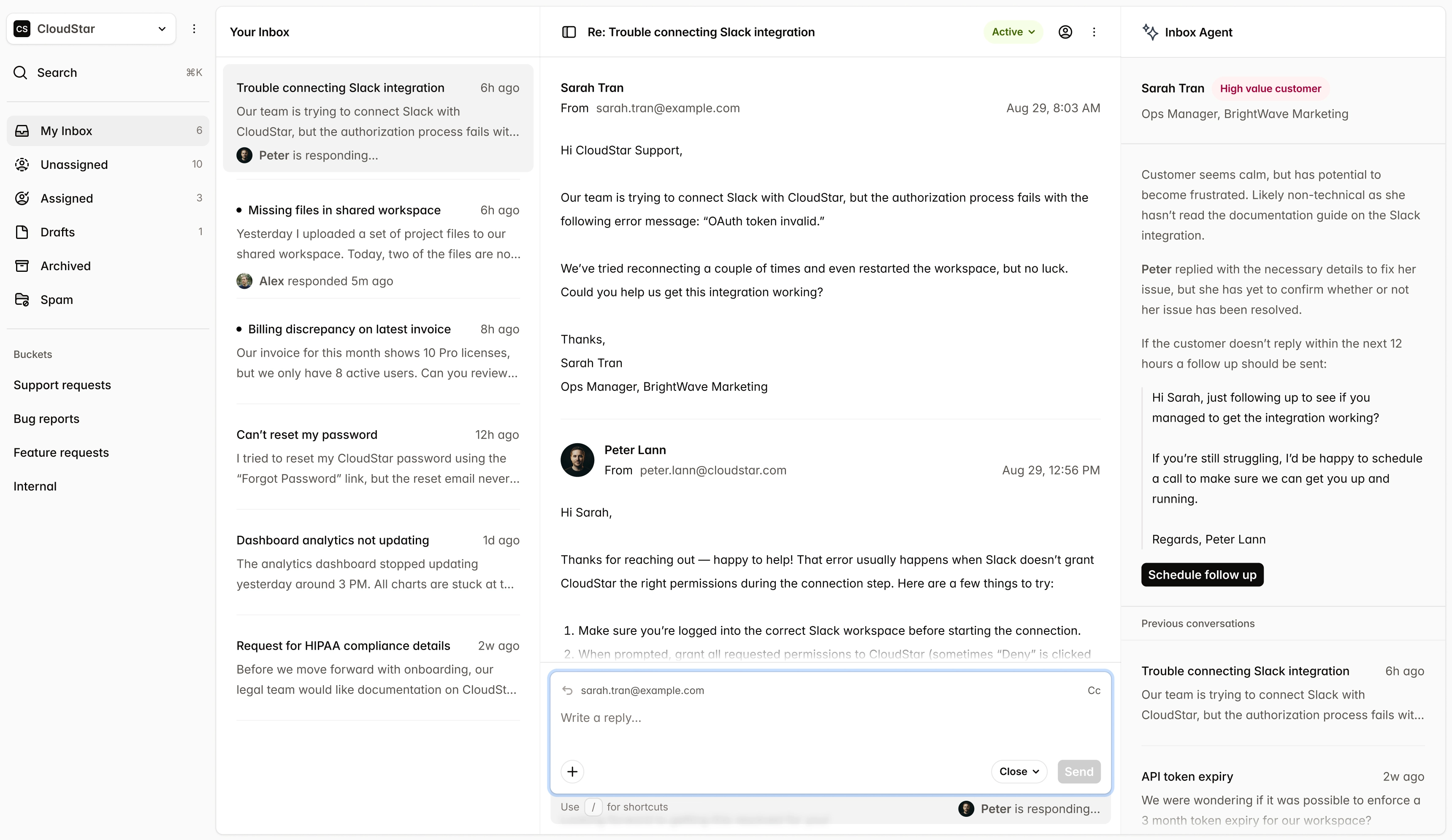

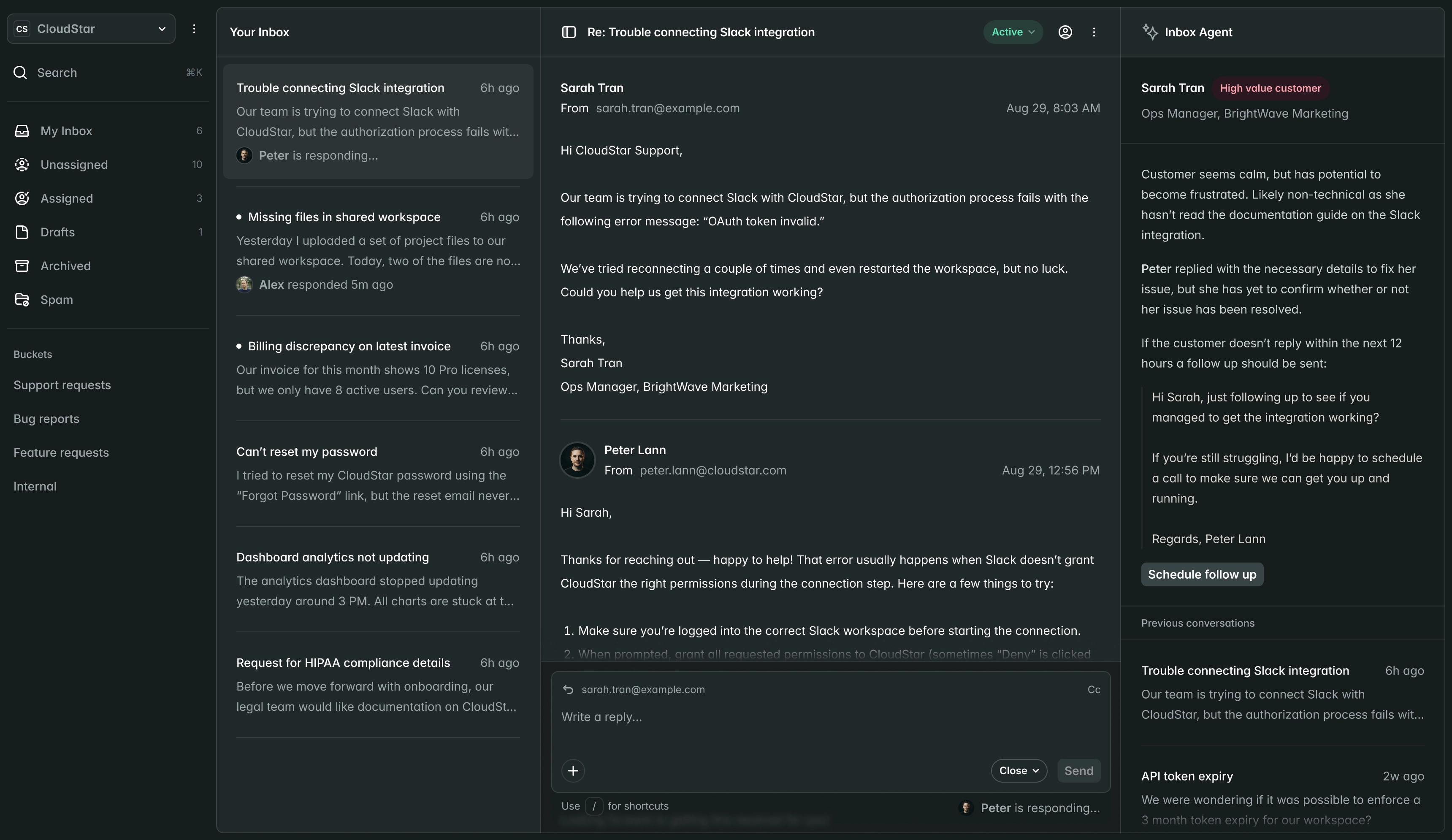

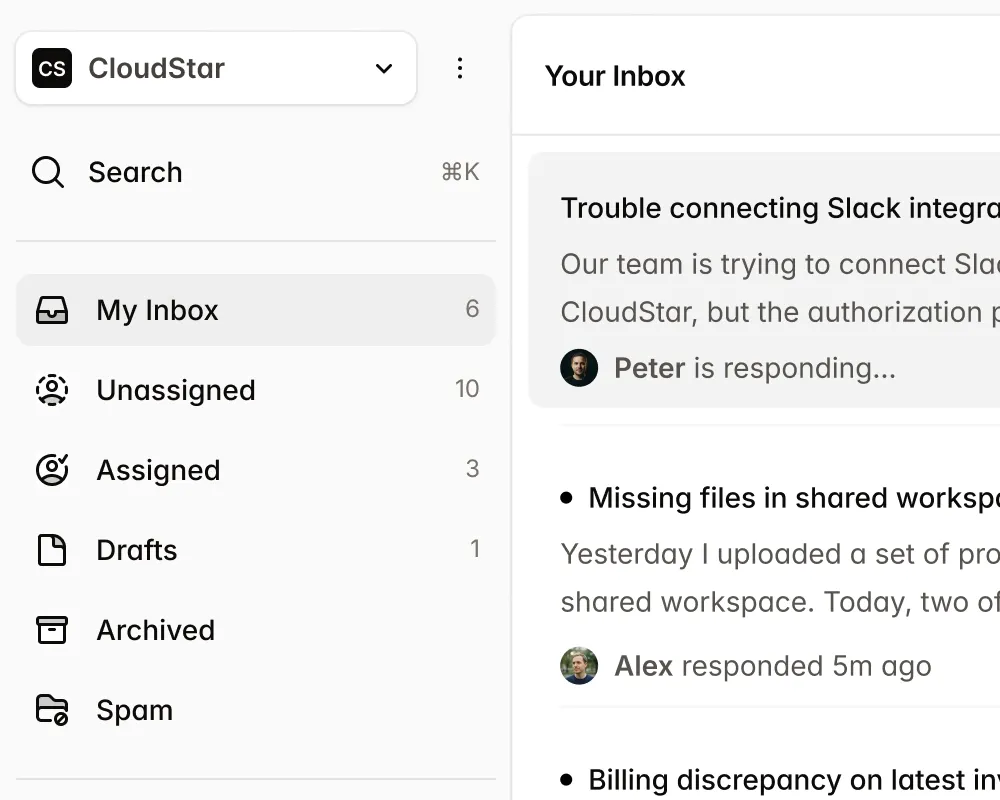

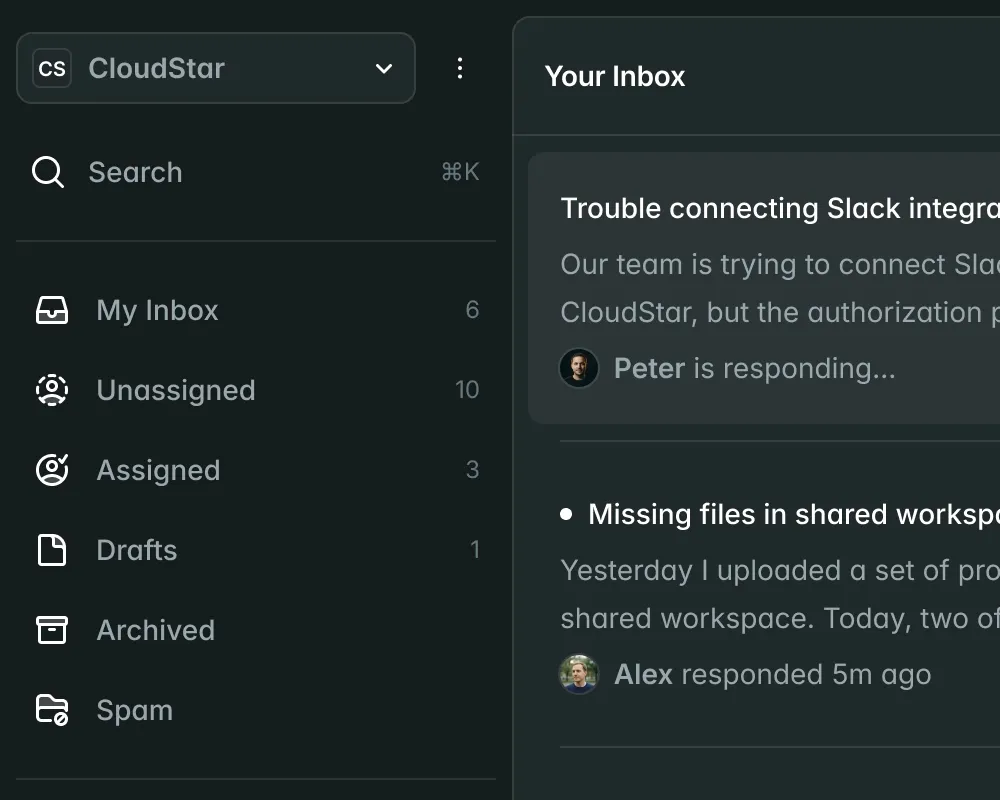

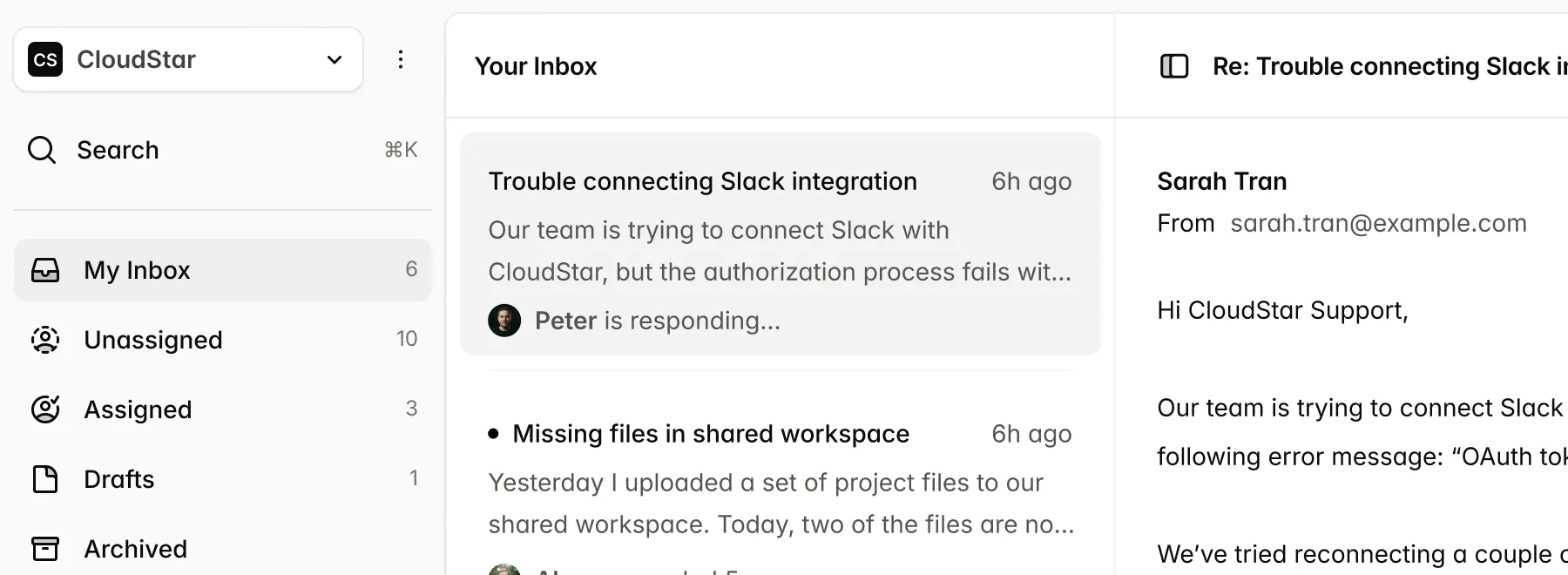

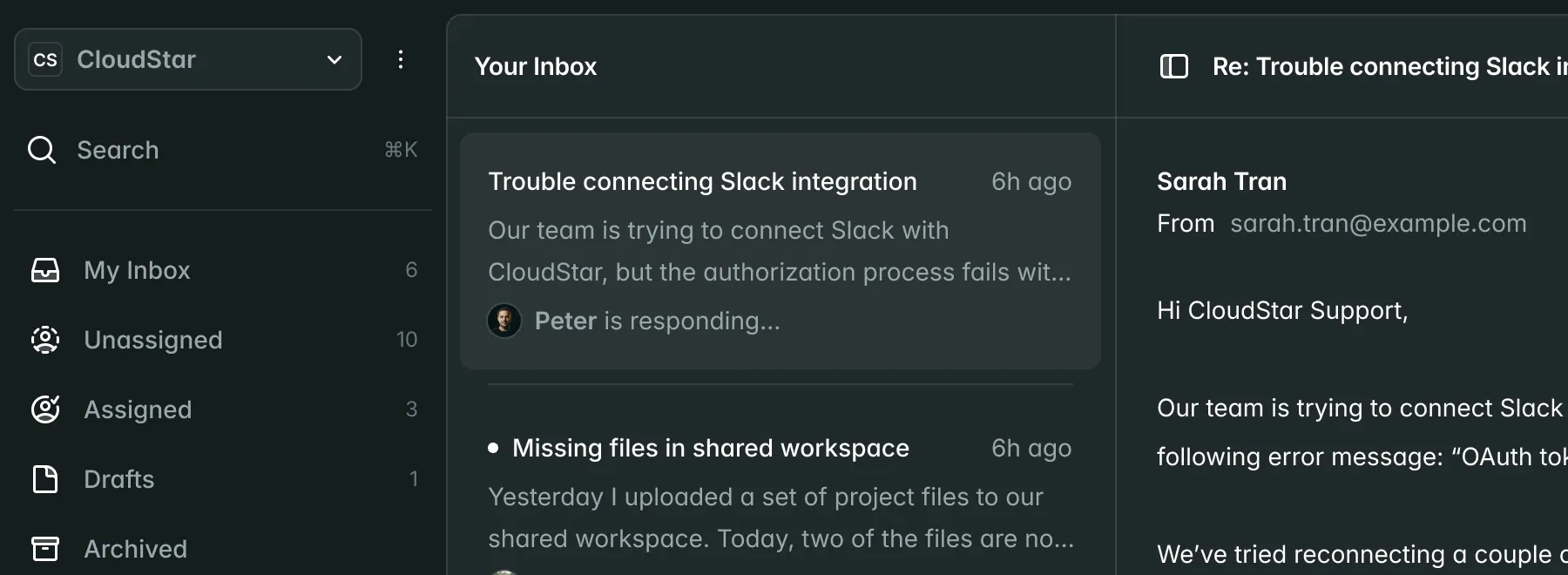

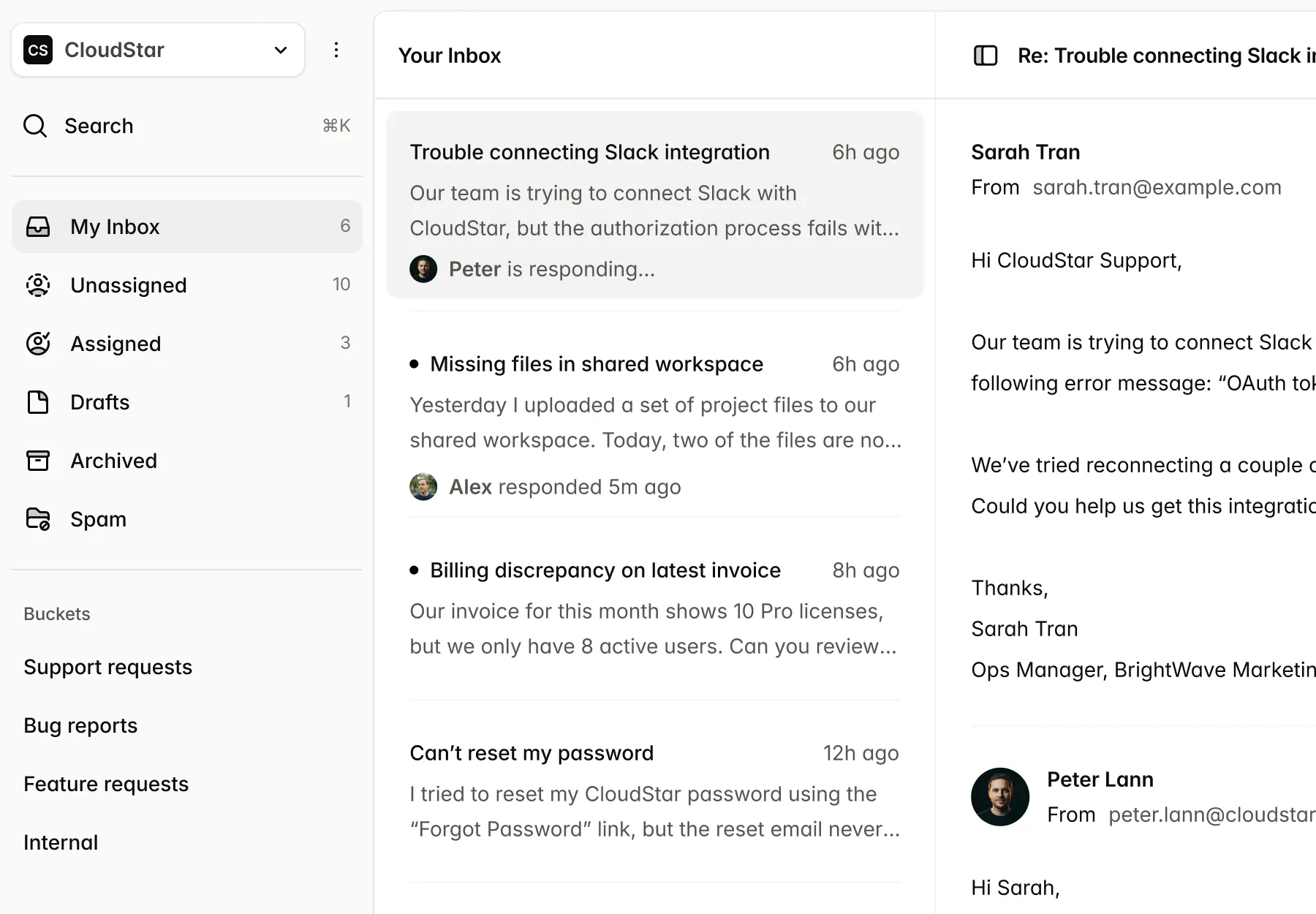

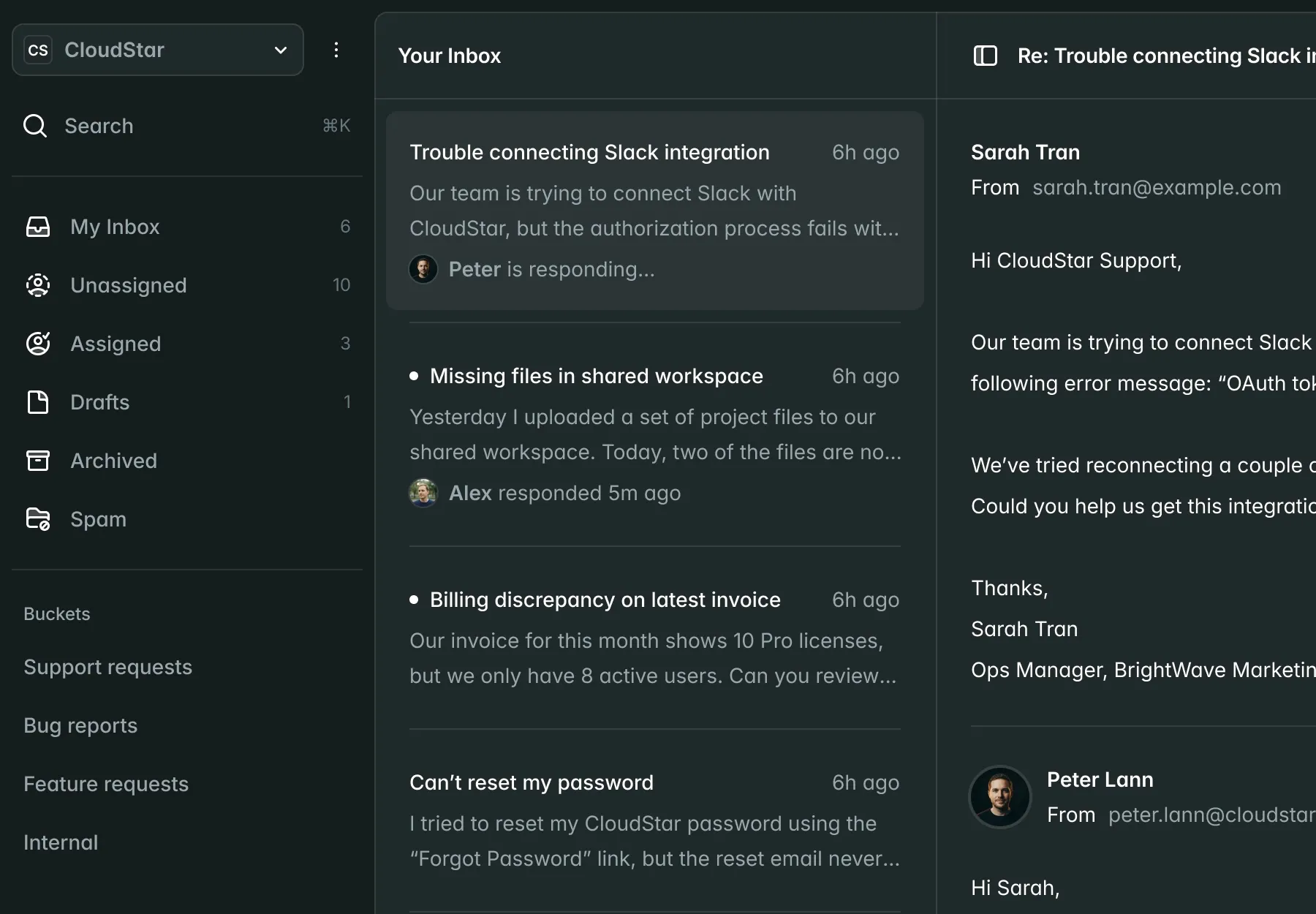

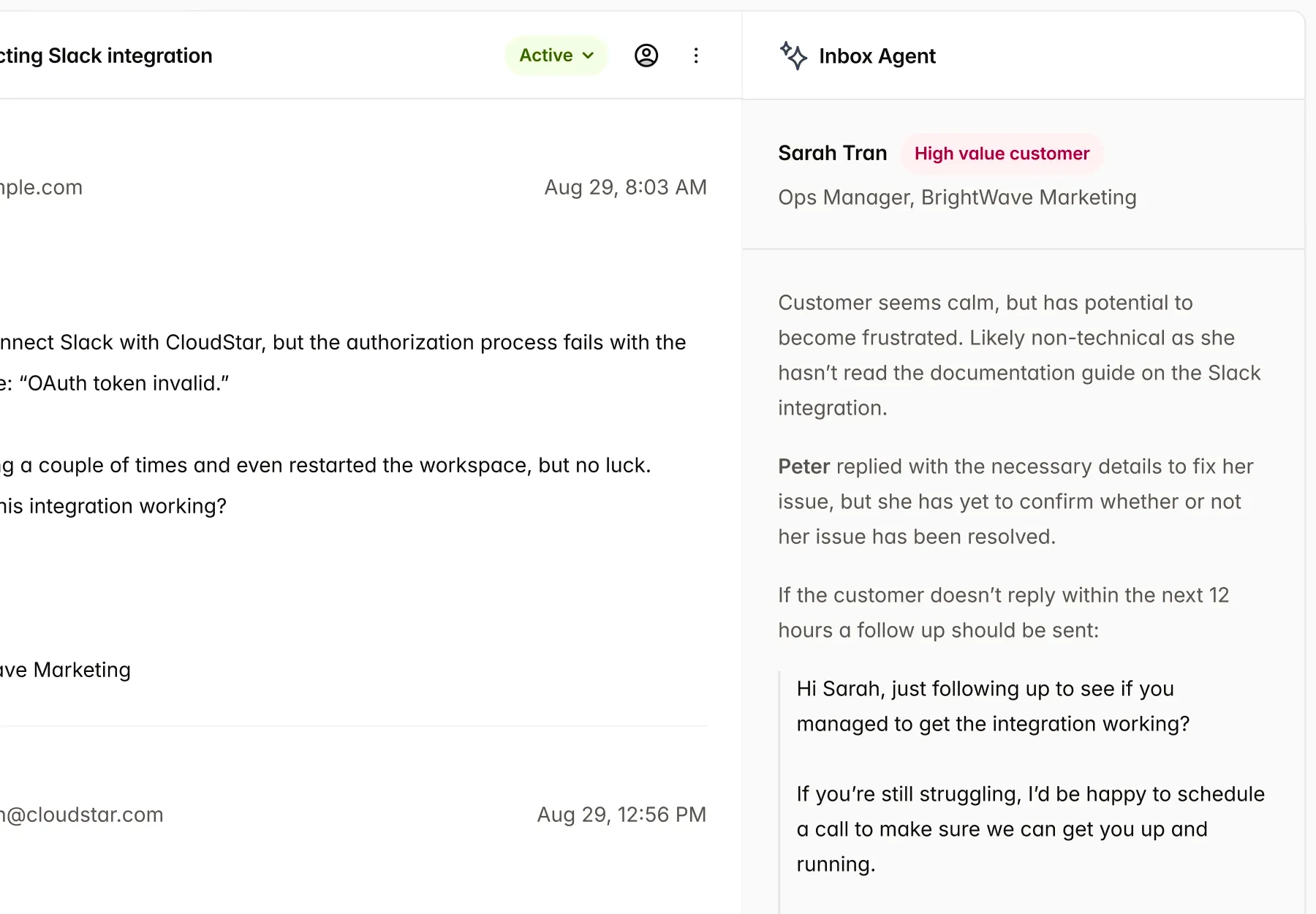

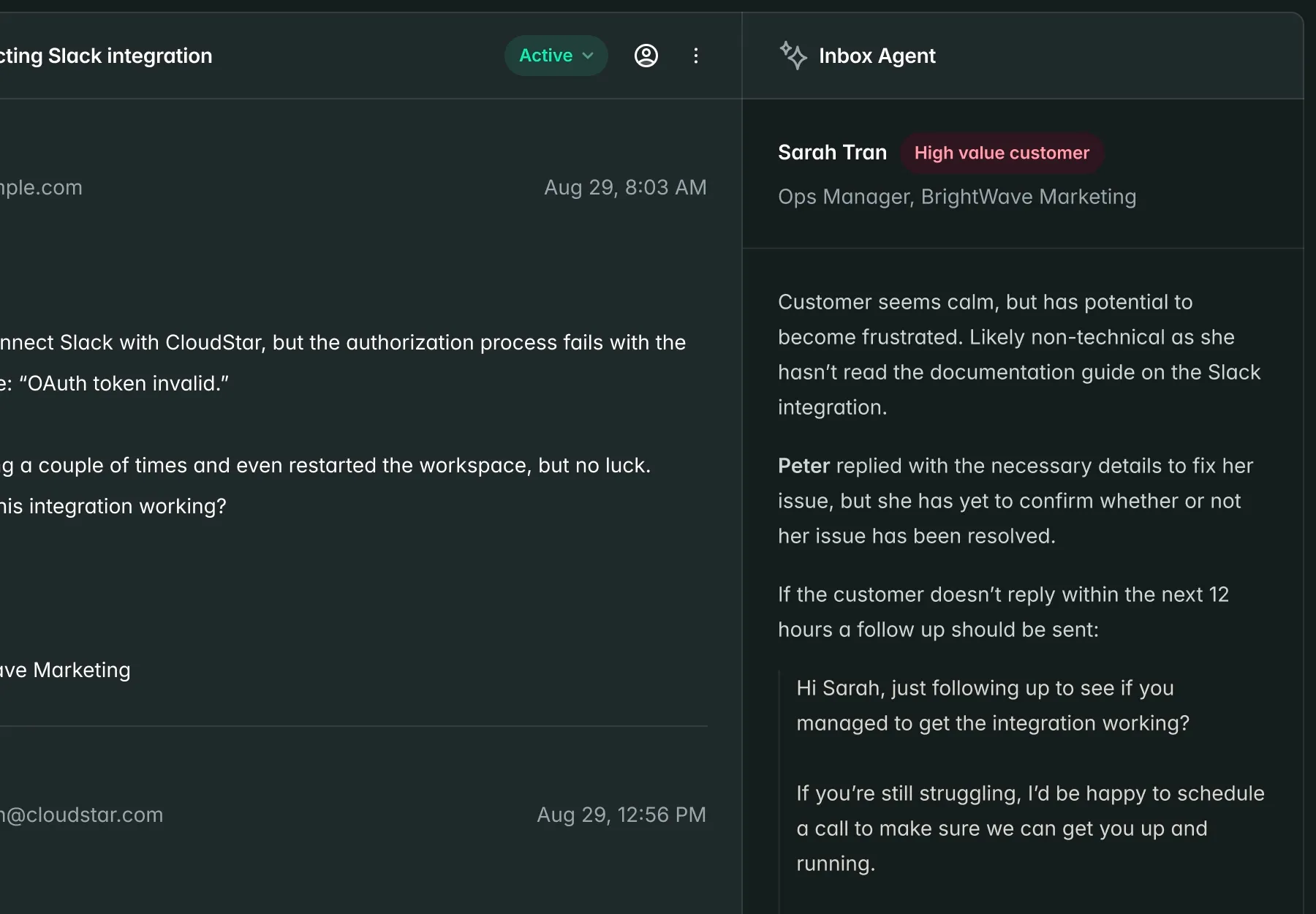

Policy Q&A

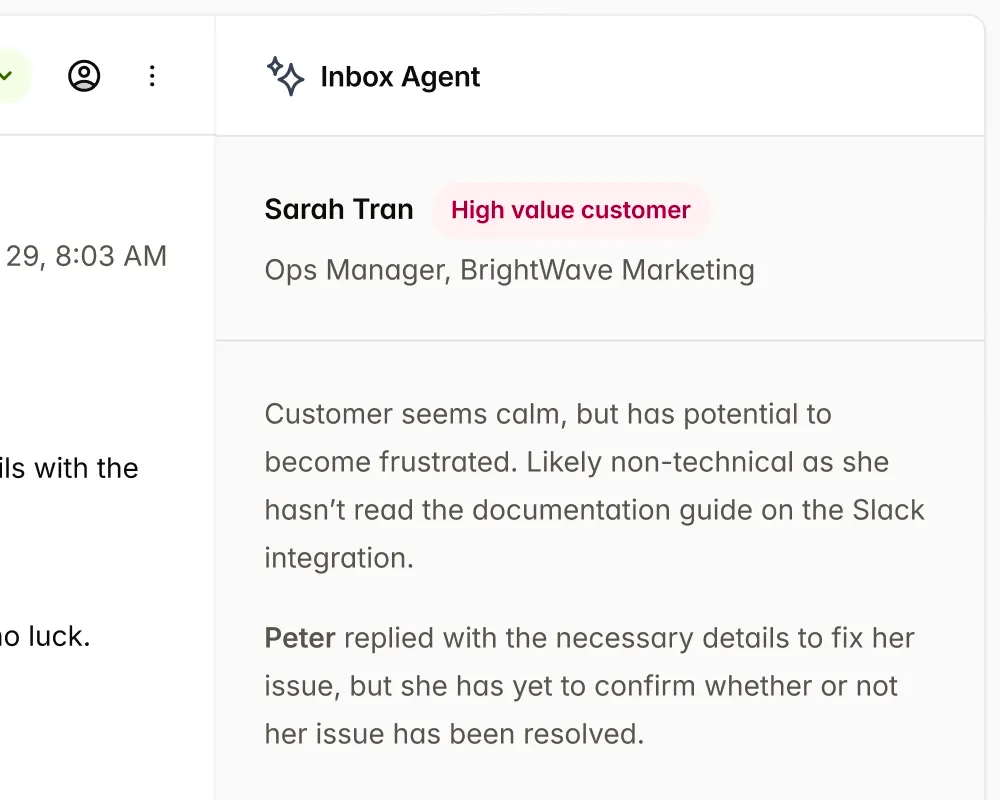

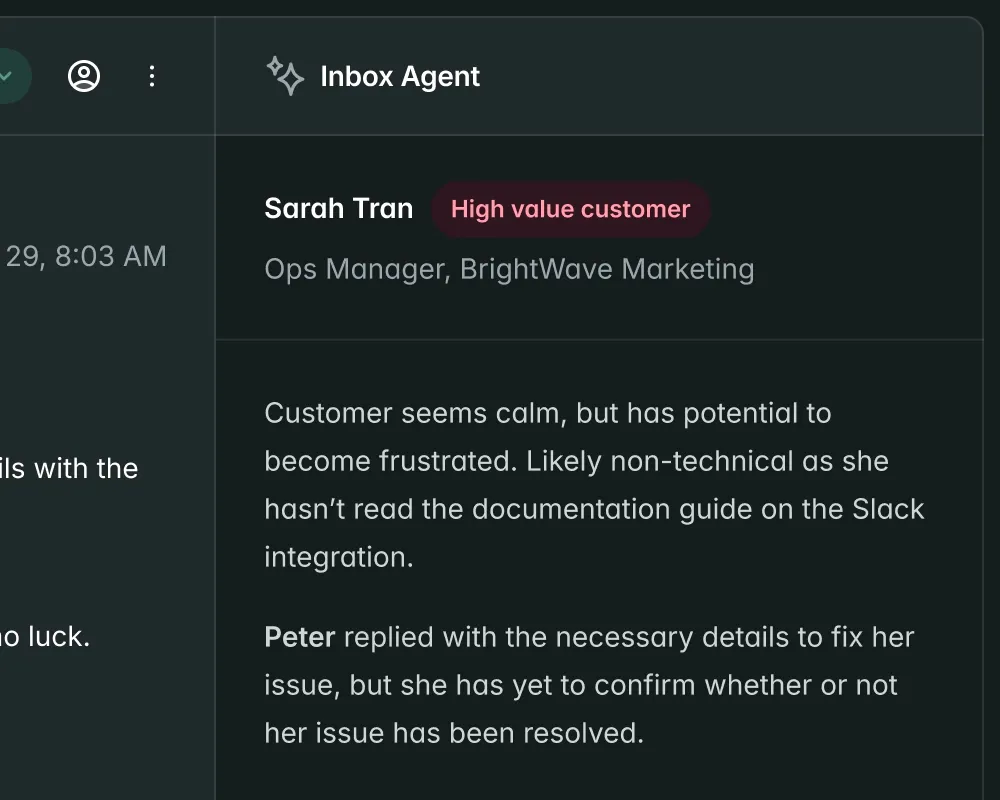

Ask questions the way you'd ask a colleague. Bulma retrieves current policy text and gives you grounded answers with source attribution.

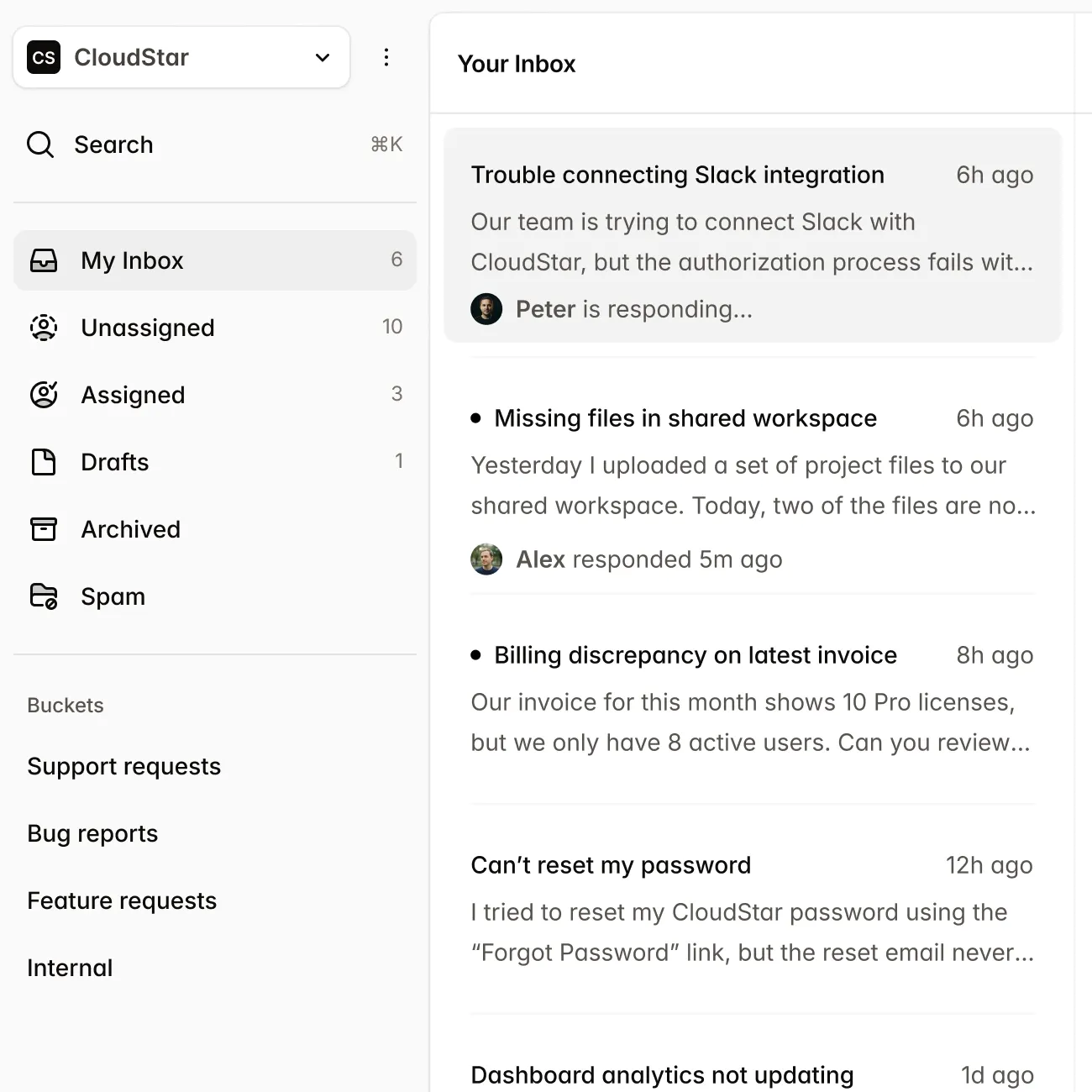

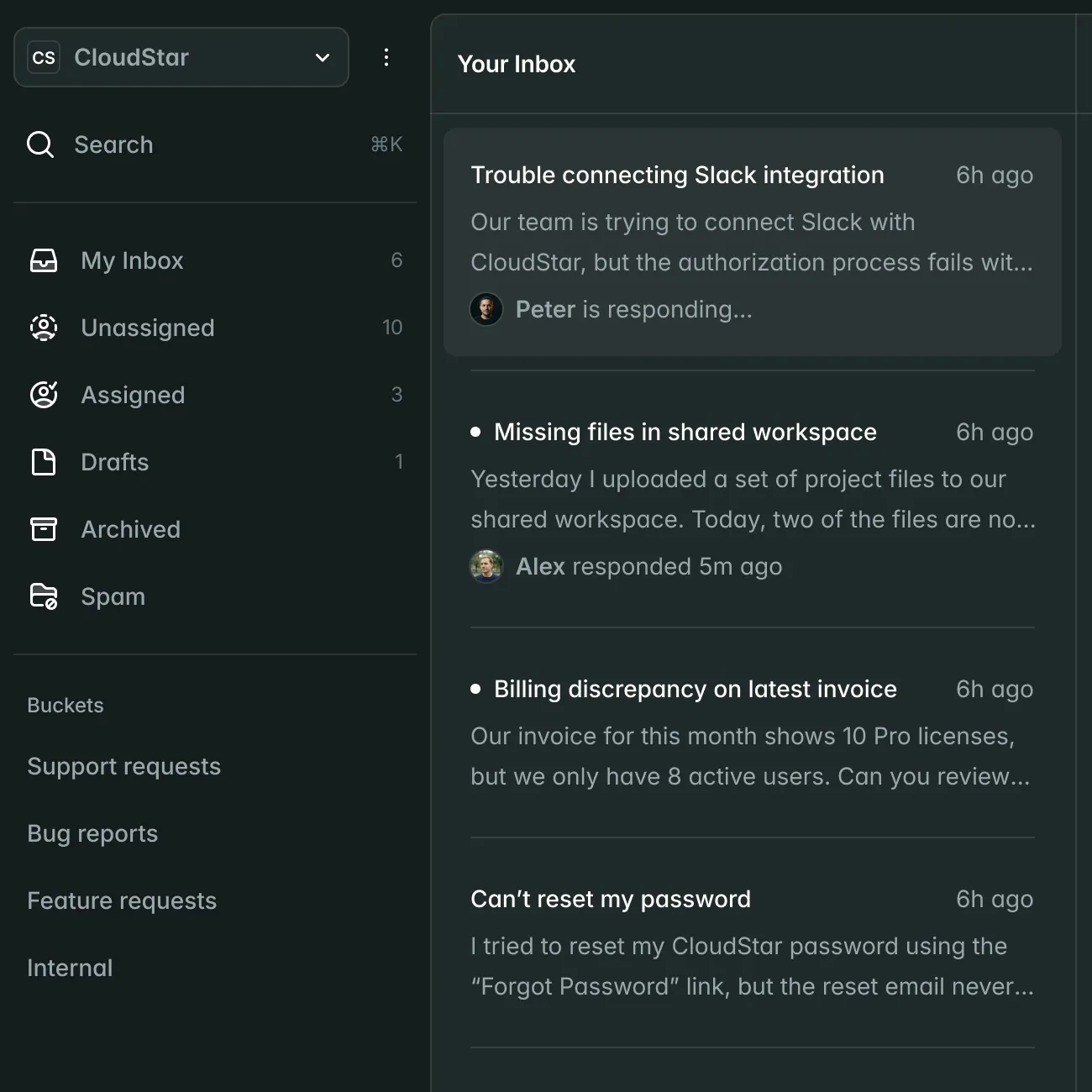

Lender Comparison

Compare policies across lenders side-by-side. Find the best fit for your client's scenario in seconds.

The policy assistant Australian brokers rely on.

Bulma helps mortgage brokers across Australia find policy answers faster, match clients to the right lenders, and close more deals with confidence.

Major Australian lenders covered, with policies updated regularly.

Average time to answer — compared to hours of manual research.

What brokers are saying

Hear from mortgage brokers who use Bulma every day to serve their clients better.

I used to spend hours checking lender portals for policy details. Now I just ask Bulma and get an answer in seconds — with the source right there so I can verify it.

Sarah Chen

Credit Adviser, Sydney

The cross-lender comparison feature is brilliant. I can instantly see which lenders will accept my client's scenario without opening five different PDFs.

Michael Torres

Senior Broker, Melbourne

For complex scenarios with casual employment or self-employed clients, Bulma saves me from making embarrassing mistakes. It knows the policy nuances I might miss.

David Nguyen

Mortgage Broker, Brisbane

Bulma understands broker terminology. I can ask about LMI thresholds, genuine savings, or income shading and get a precise answer without having to explain what I mean.

Emma Williams

Credit Adviser, Perth

My team uses Bulma as our first stop for policy questions. It's like having a senior broker on call 24/7 who never forgets a policy update.

James Mitchell

Principal Broker, Adelaide

The source attribution is what sold me. I can see exactly which lender policy and category the answer came from, and when it was last updated. That transparency matters.

Rachel Cooper

Lending Specialist, Gold Coast

Questions & Answers

Simple pricing for every brokerage.

Solo

$49/mo

For individual brokers getting started

Unlimited policy questions

All major lenders covered

Source attribution on every answer

Conversation history

Email support

Team

$99/mo

For growing brokerages with multiple users

Everything in Solo

Up to 5 team members

Cross-lender comparisons

Priority support

Team usage analytics

Shared conversation history

Enterprise

Custom

For aggregators and large brokerages

Everything in Team

Unlimited team members

Custom lender coverage

Dedicated account manager

Custom integrations

Volume discounts

Ready to spend less time on policy research?

Join brokers across Australia who use Bulma to answer policy questions faster, match clients to the right lenders, and close more deals with confidence.